Account Management System

Account Management System

Account Management System

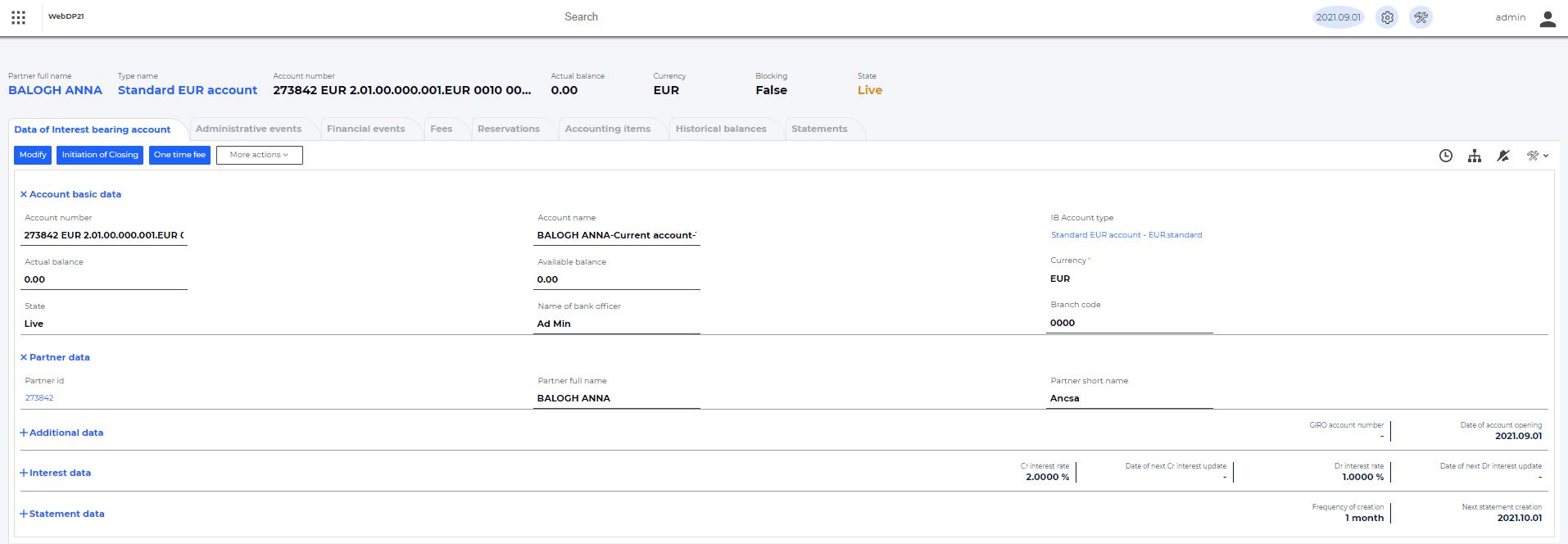

The ApPello Account Management System (AMS) is a 24/7 multi-currency account and balance management solution with full interest-bearing capabilities. It integrates seamlessly with other business modules (Loans, Fees, Collaterals) and external systems to ensure accurate accounting of all financial events.

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.