Core Banking for Lenders

Core Banking for Lenders

Core Banking for Lenders

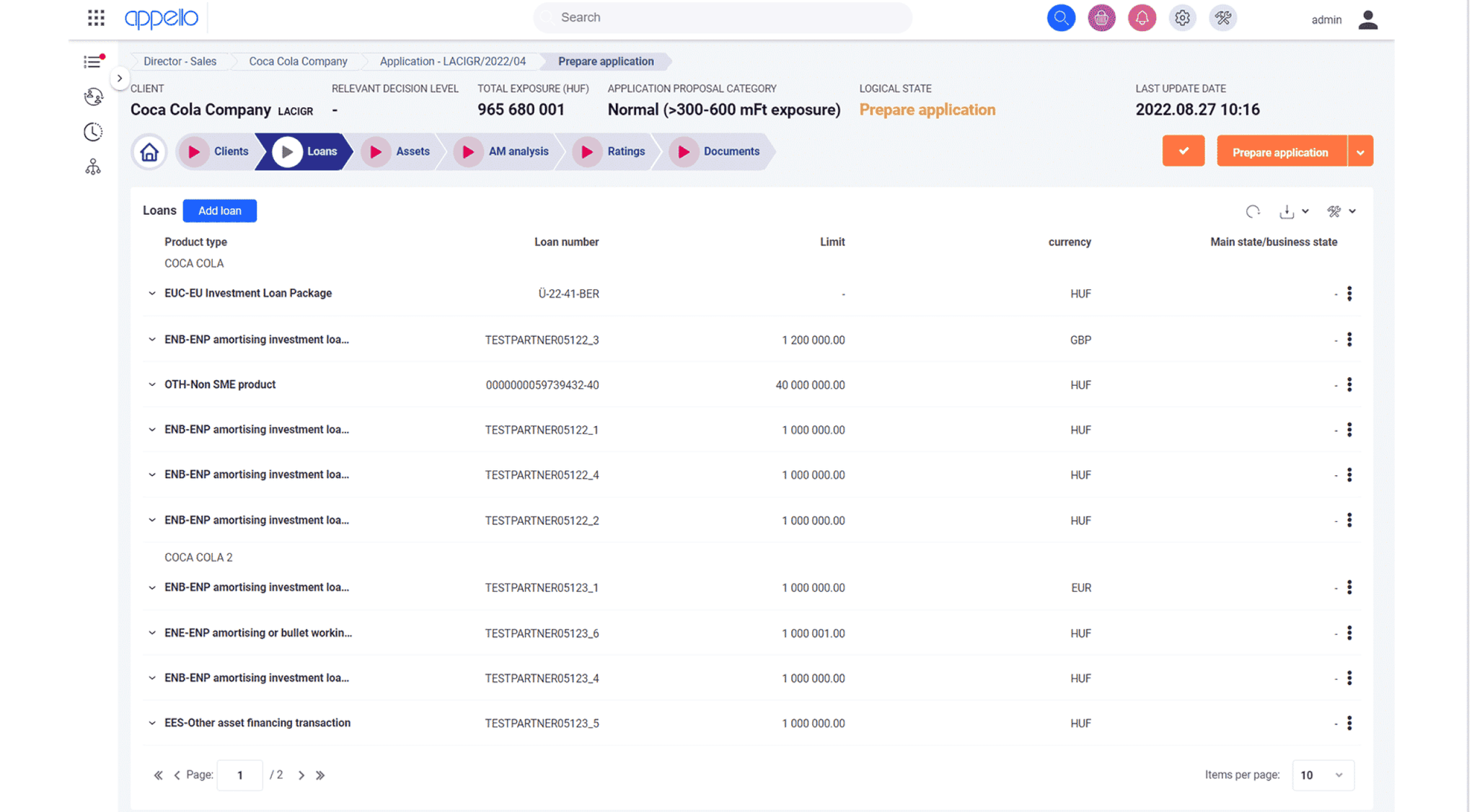

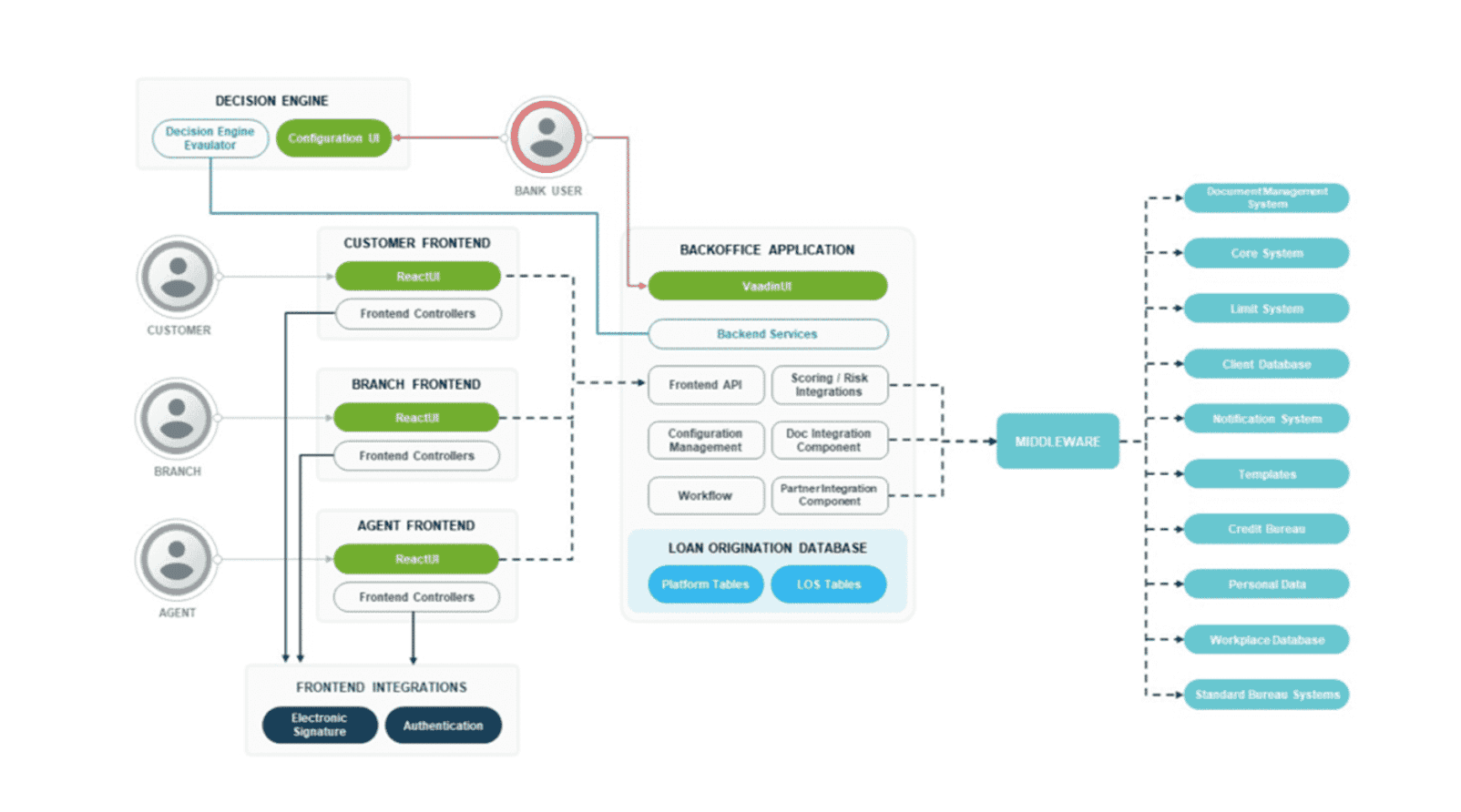

Stay competitive in the digital era while ensuring high levels of service and efficiency. ApPello’s real-time, cloud-based Core Banking System (CBS) is designed to support key functionalities such as current accounts, savings, and lending.

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.