Decision Engine

Decision Engine

Decision Engine

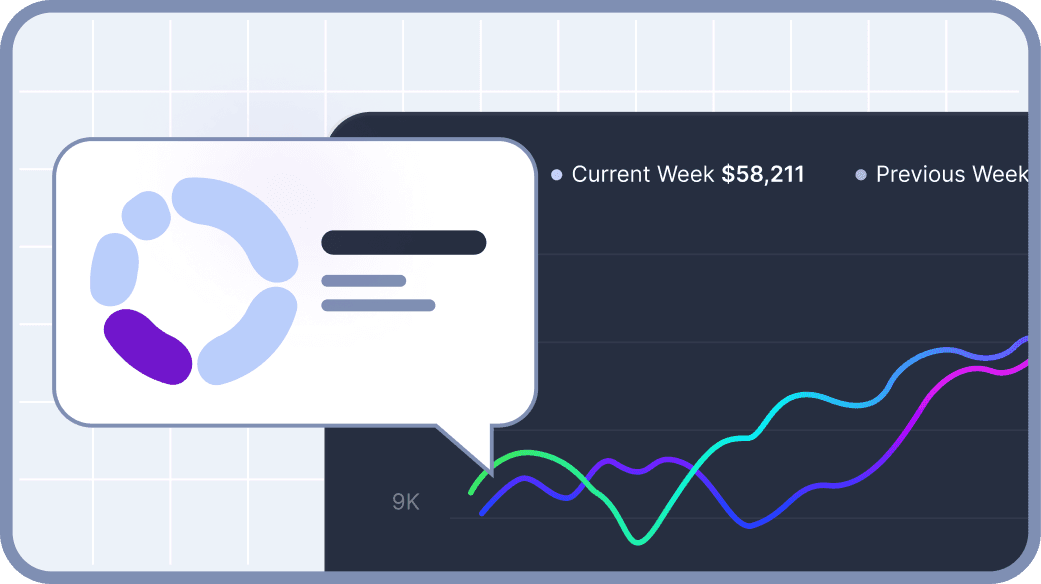

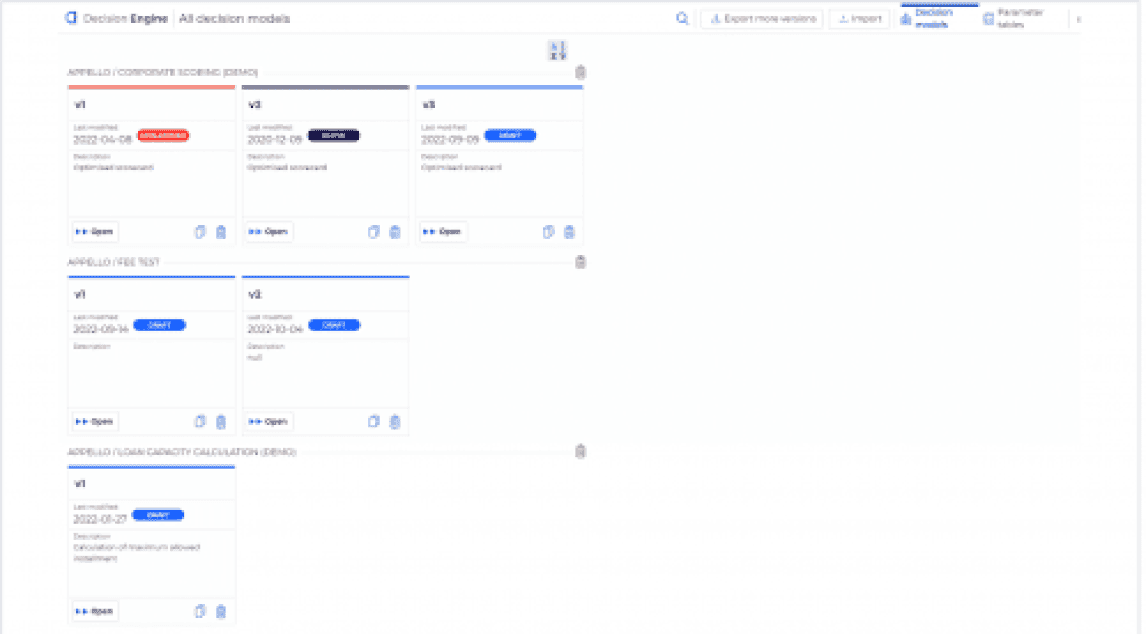

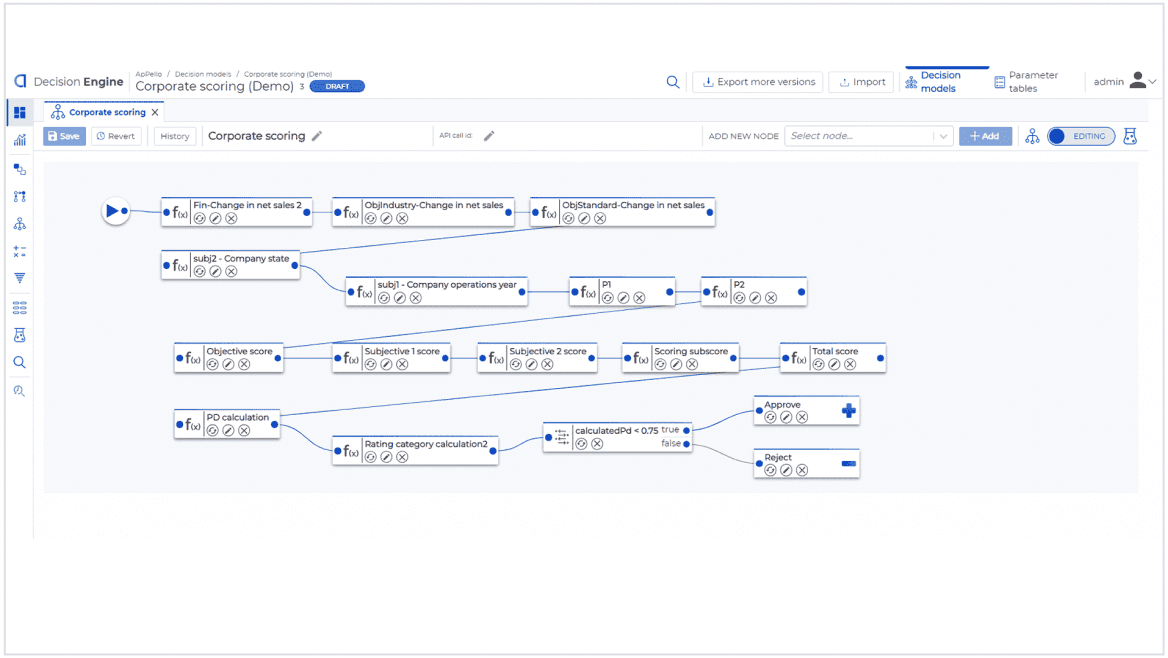

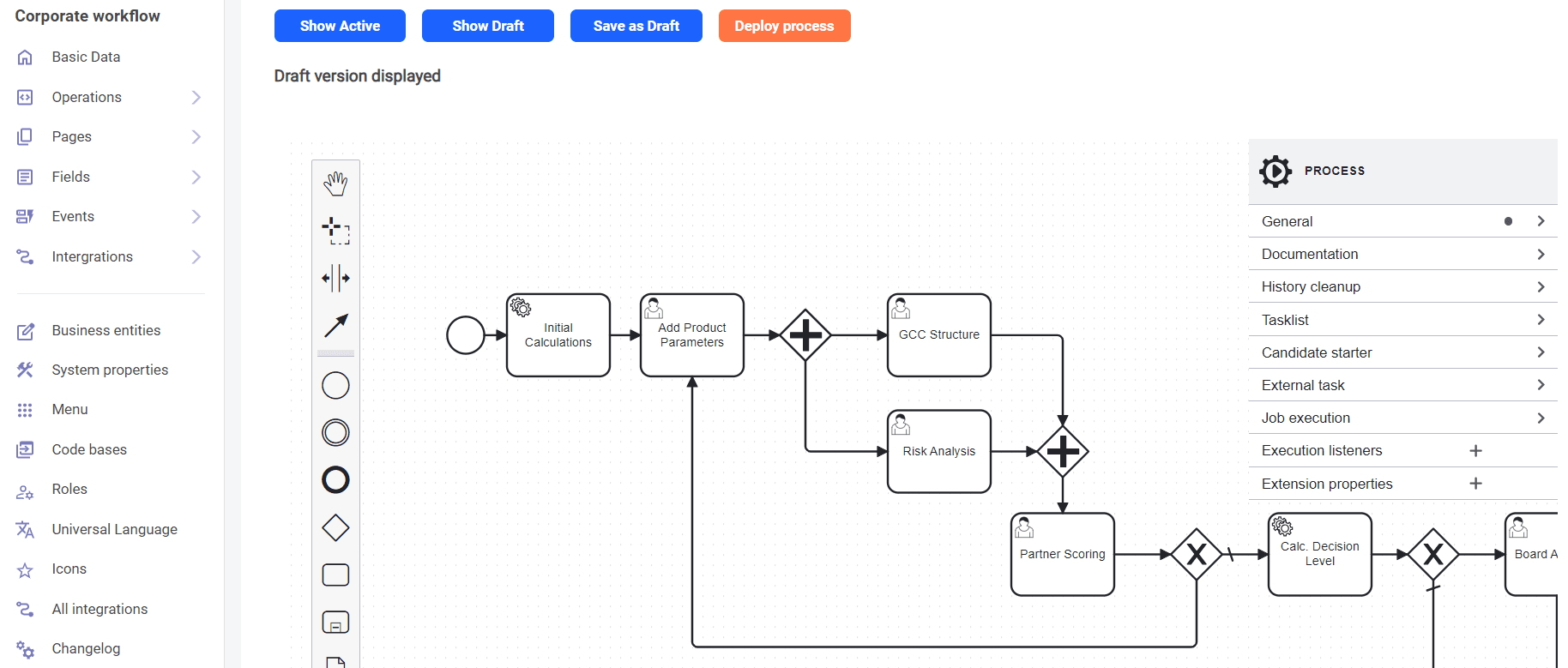

The clockwork of automation, the Decision Engine is an easily configurable tool to set up and run complex calculations and decision tree-based decision algorithms, even for non-technical users.

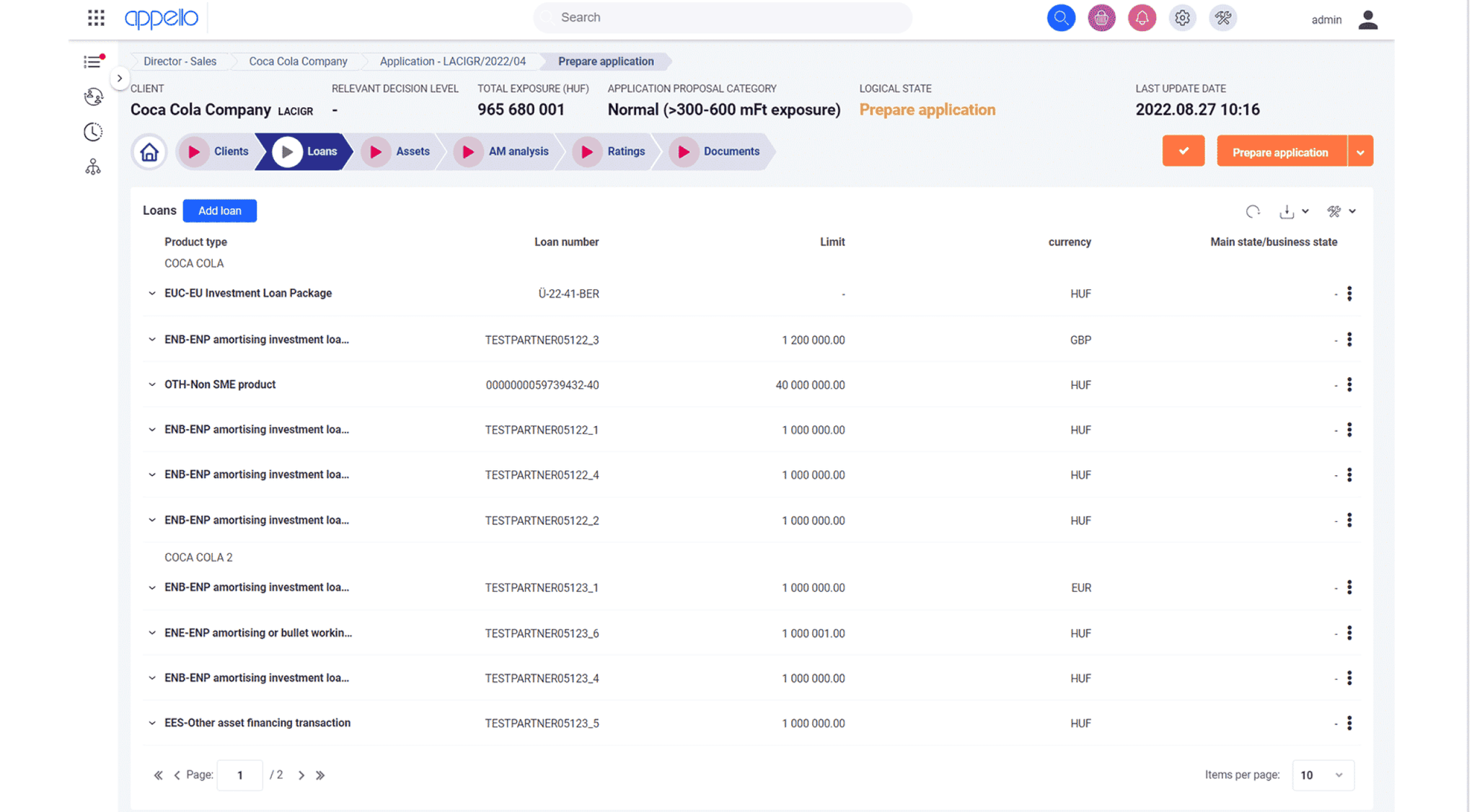

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.

ApPello offers cutting-edge digital lending solutions for banks of all sizes, ensuring efficiency and scalability in loan origination and servicing.