Stay one step ahead with Early Warning & Loan Monitoring software, empowering your bank to detect risks and ensure seamless credit management in real-time.

Discover Product Details

Conventional credit monitoring & Early warning actively facilitates the prompt management of emerging concerns by initiating policy actions at the onset, effectively preventing any further decline in a client’s financial condition.

Discover Product Details

Conventional credit monitoring & Early warning actively facilitates the prompt management of emerging concerns by initiating policy actions at the onset, effectively preventing any further decline in a client’s financial condition.

Discover Product Details

Conventional credit monitoring & Early warning actively facilitates the prompt management of emerging concerns by initiating policy actions at the onset, effectively preventing any further decline in a client’s financial condition.

Discover Product Details

Conventional credit monitoring & Early warning actively facilitates the prompt management of emerging concerns by initiating policy actions at the onset, effectively preventing any further decline in a client’s financial condition.

Main Benefits

Main Benefits

Out of the Box - Early identification of non-performing loans & efficient credit monitoring

AI generated warning signals and action plan suggestion

Parameterizable alerting mechanism, Automated detection of early warning signals

Classification, segmentation and strategy management

Classification, segmentation and strategy management

Action plans & risk intervention

management

Action plans & risk intervention

management

Provision and RWA mitigation, asset quality and solvency improvement

Workflow

Workflow

Product Features

Product Features

AI Engine

ApPello’s AI Engine plays a pivotal role in detecting early stress signals through the utilization of advanced AI capabilities.

Harnessing the capabilities of AI, the system unearths latent patterns within customer behavior, thereby shifting manual monitoring from a retrospective approach to a proactive stance in risk management.

AI Engine

ApPello’s AI Engine plays a pivotal role in detecting early stress signals through the utilization of advanced AI capabilities.

Harnessing the capabilities of AI, the system unearths latent patterns within customer behavior, thereby shifting manual monitoring from a retrospective approach to a proactive stance in risk management.

AI Engine

ApPello’s AI Engine plays a pivotal role in detecting early stress signals through the utilization of advanced AI capabilities.

Harnessing the capabilities of AI, the system unearths latent patterns within customer behavior, thereby shifting manual monitoring from a retrospective approach to a proactive stance in risk management.

AI Engine

ApPello’s AI Engine plays a pivotal role in detecting early stress signals through the utilization of advanced AI capabilities.

Harnessing the capabilities of AI, the system unearths latent patterns within customer behavior, thereby shifting manual monitoring from a retrospective approach to a proactive stance in risk management.

Statistical based flexible Early Warning engine

The system operates a personalized and expandable early warning signal set. These signals might encompass factors like: reduced account turnovers, delayed payments, alterations in client ratings, or data from an external credit blacklist, among others.

Statistical based flexible Early Warning engine

The system operates a personalized and expandable early warning signal set. These signals might encompass factors like: reduced account turnovers, delayed payments, alterations in client ratings, or data from an external credit blacklist, among others.

Statistical based flexible Early Warning engine

The system operates a personalized and expandable early warning signal set. These signals might encompass factors like: reduced account turnovers, delayed payments, alterations in client ratings, or data from an external credit blacklist, among others.

Statistical based flexible Early Warning engine

The system operates a personalized and expandable early warning signal set. These signals might encompass factors like: reduced account turnovers, delayed payments, alterations in client ratings, or data from an external credit blacklist, among others.

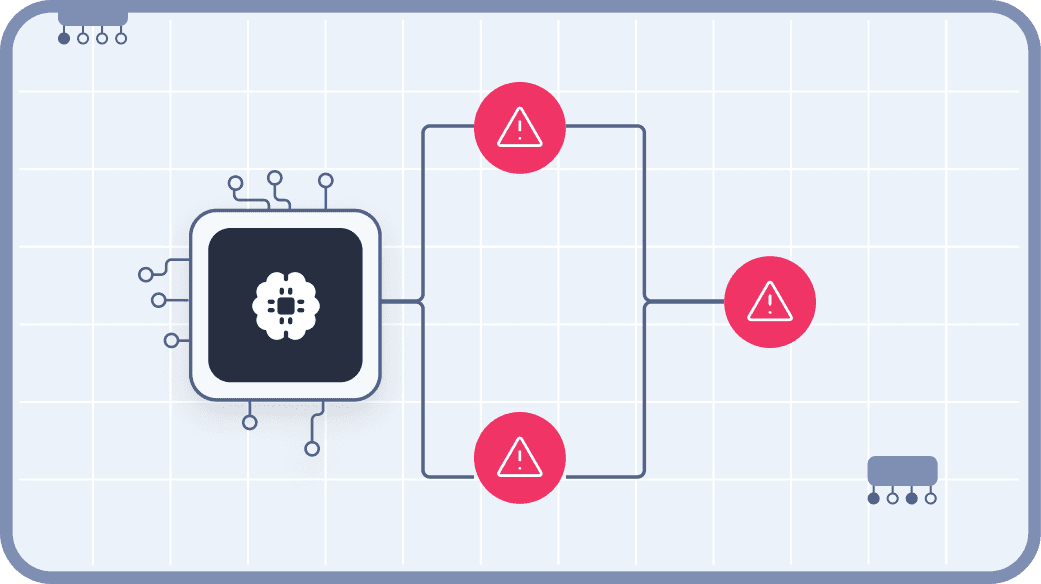

Workflow based escalation process

The classification process initiates automatically, driven by business rules that assess the warning signals and suggest an initial client rating. In tandem, business and risk management specialists can contribute their evaluations, which further inform the client’s rating and subsequently guide the development of an action plan.

Workflow based escalation process

The classification process initiates automatically, driven by business rules that assess the warning signals and suggest an initial client rating. In tandem, business and risk management specialists can contribute their evaluations, which further inform the client’s rating and subsequently guide the development of an action plan.

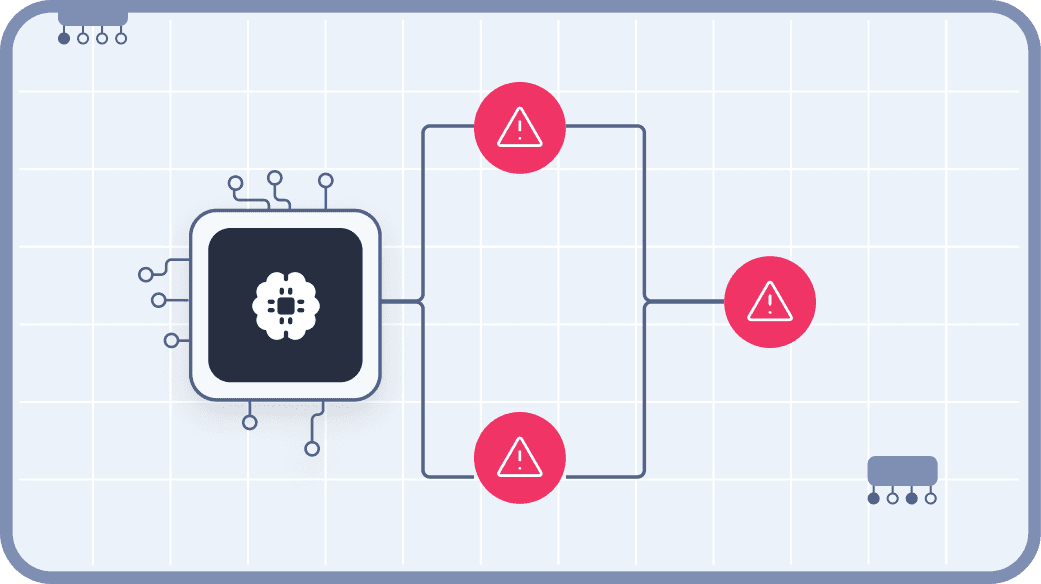

Workflow based escalation process

The classification process initiates automatically, driven by business rules that assess the warning signals and suggest an initial client rating. In tandem, business and risk management specialists can contribute their evaluations, which further inform the client’s rating and subsequently guide the development of an action plan.

Flexible scorecard definition

The classification process initiates automatically, driven by business rules that assess the warning signals and suggest an initial client rating. In tandem, business and risk management specialists can contribute their evaluations, which further inform the client’s rating and subsequently guide the development of an action plan.

Action plans and handling of risk mitigation tasks

Beyond the mere identification of issues, the system takes charge of their resolution through the formulation of adaptable action plans, devised according to the indicator signals.

Action plans and handling of risk mitigation tasks

Beyond the mere identification of issues, the system takes charge of their resolution through the formulation of adaptable action plans, devised according to the indicator signals.

Action plans and handling of risk mitigation tasks

Beyond the mere identification of issues, the system takes charge of their resolution through the formulation of adaptable action plans, devised according to the indicator signals.

Action plans and handling of risk mitigation tasks

Beyond the mere identification of issues, the system takes charge of their resolution through the formulation of adaptable action plans, devised according to the indicator signals.

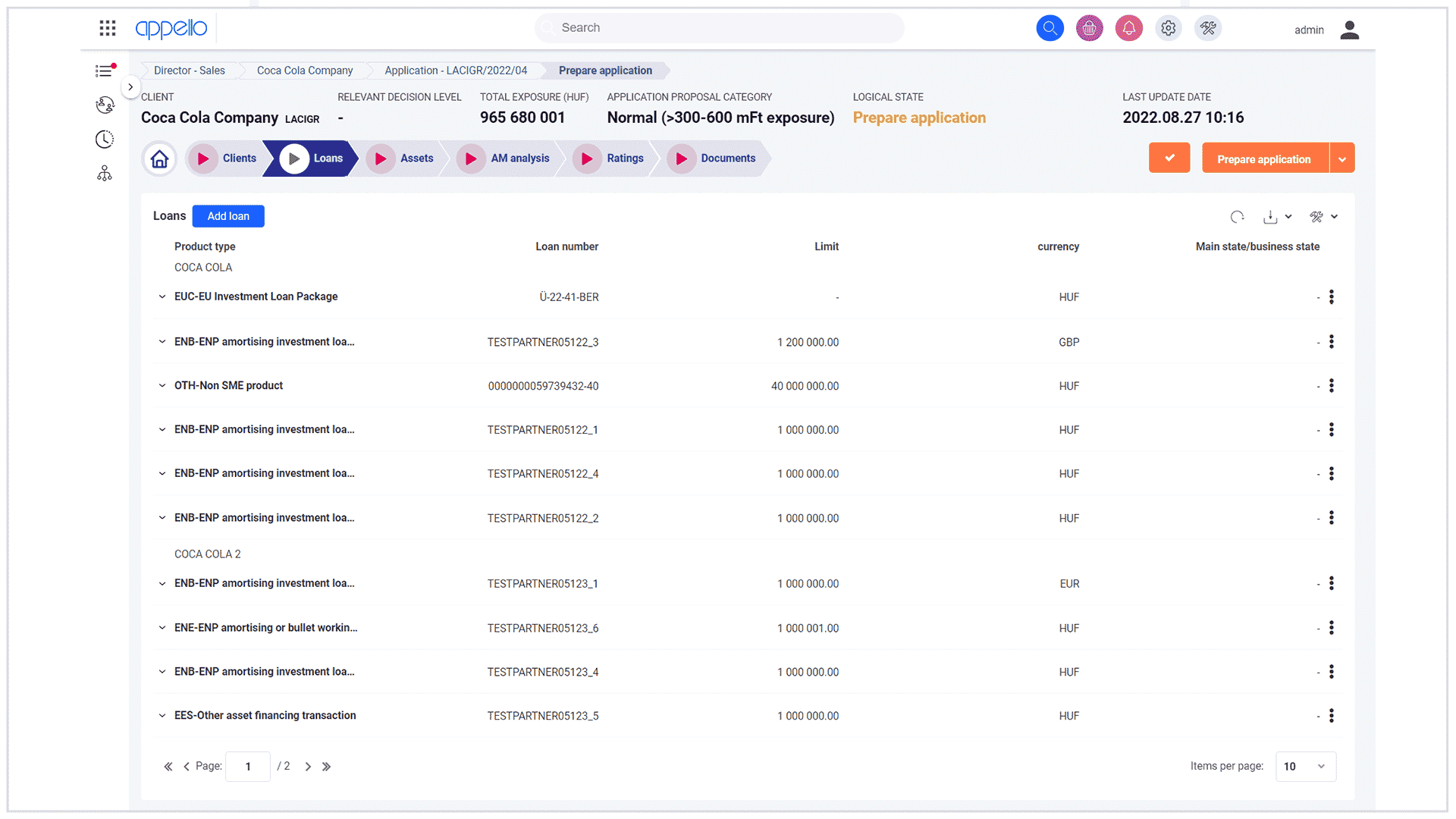

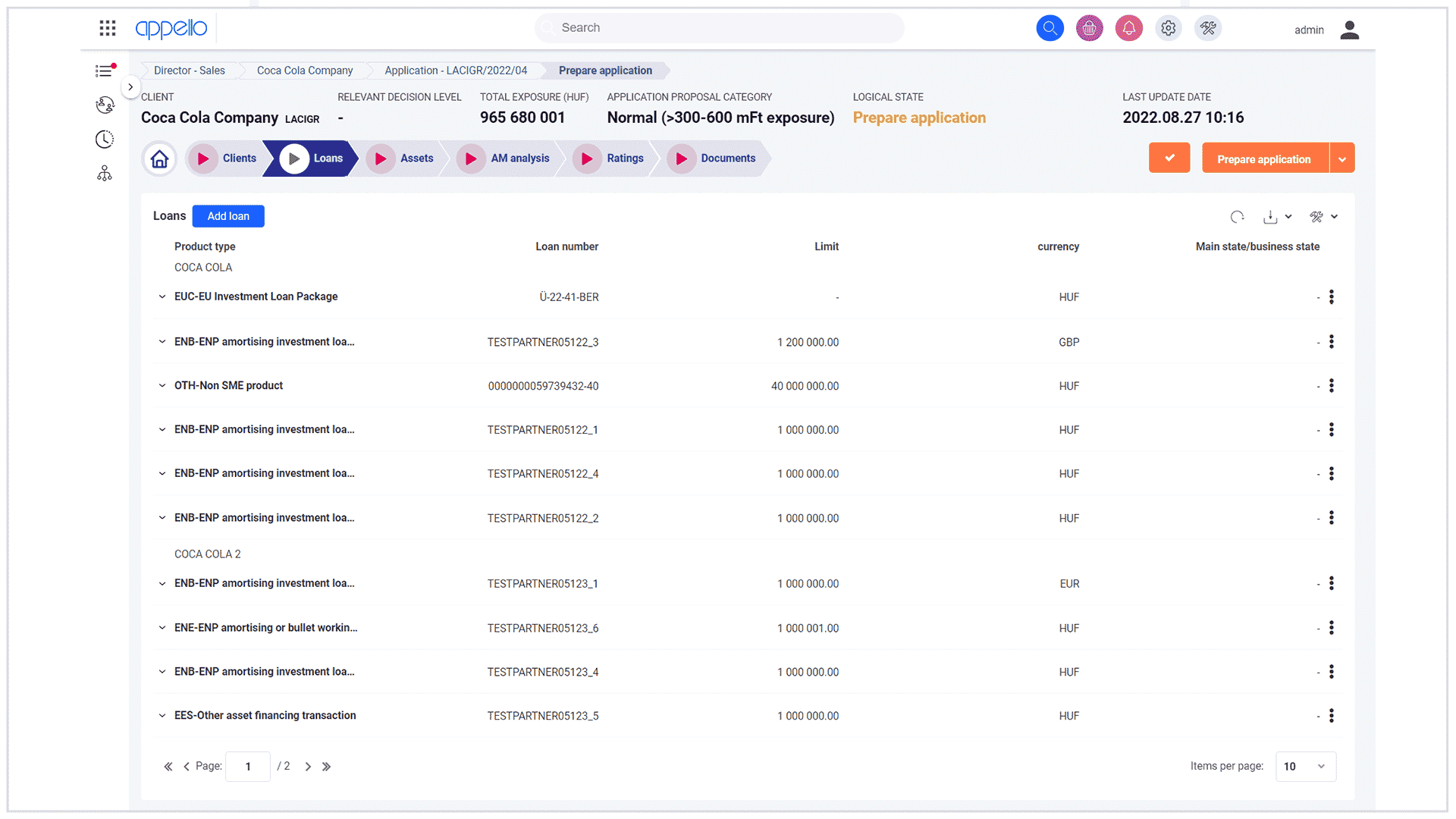

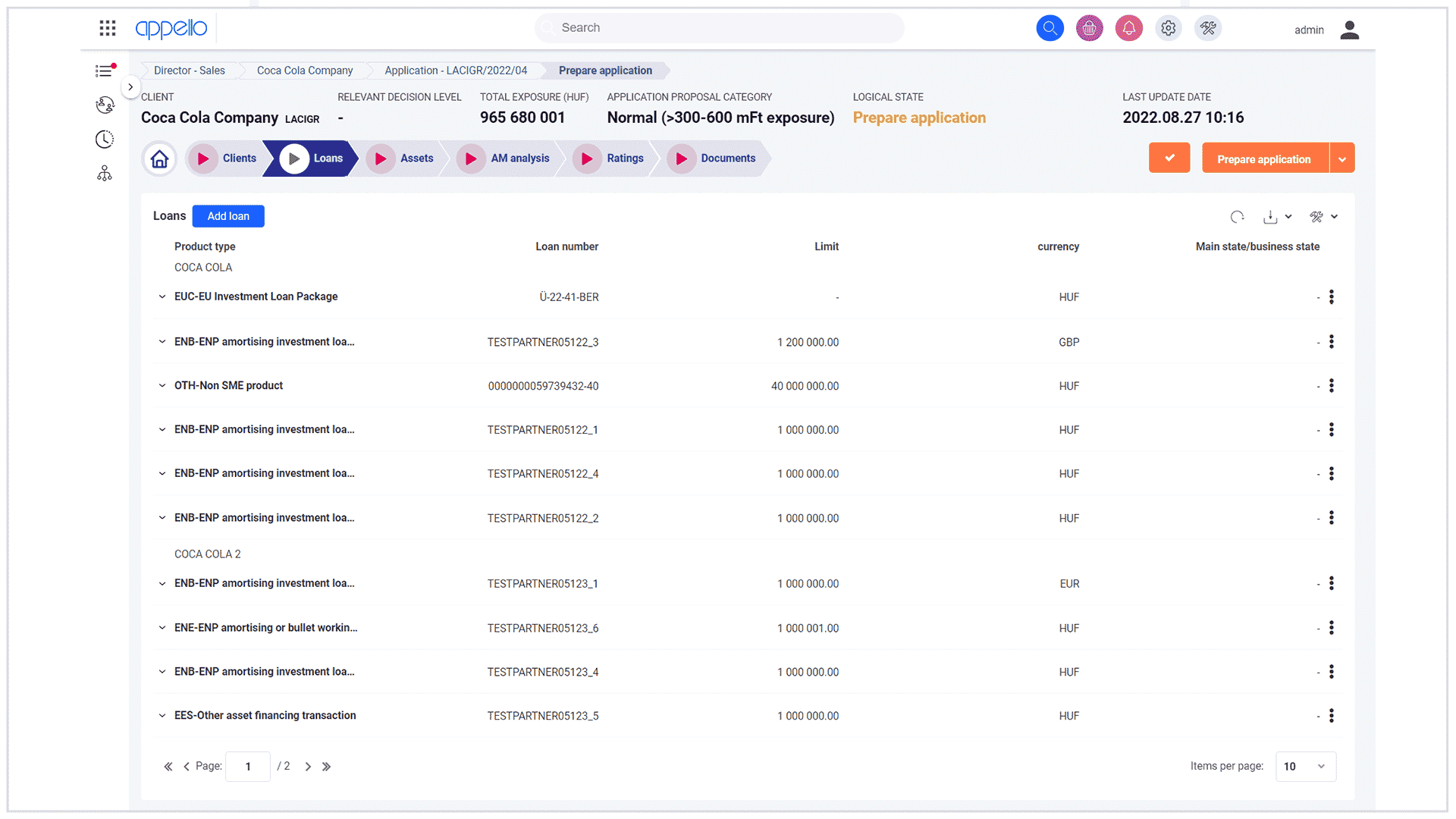

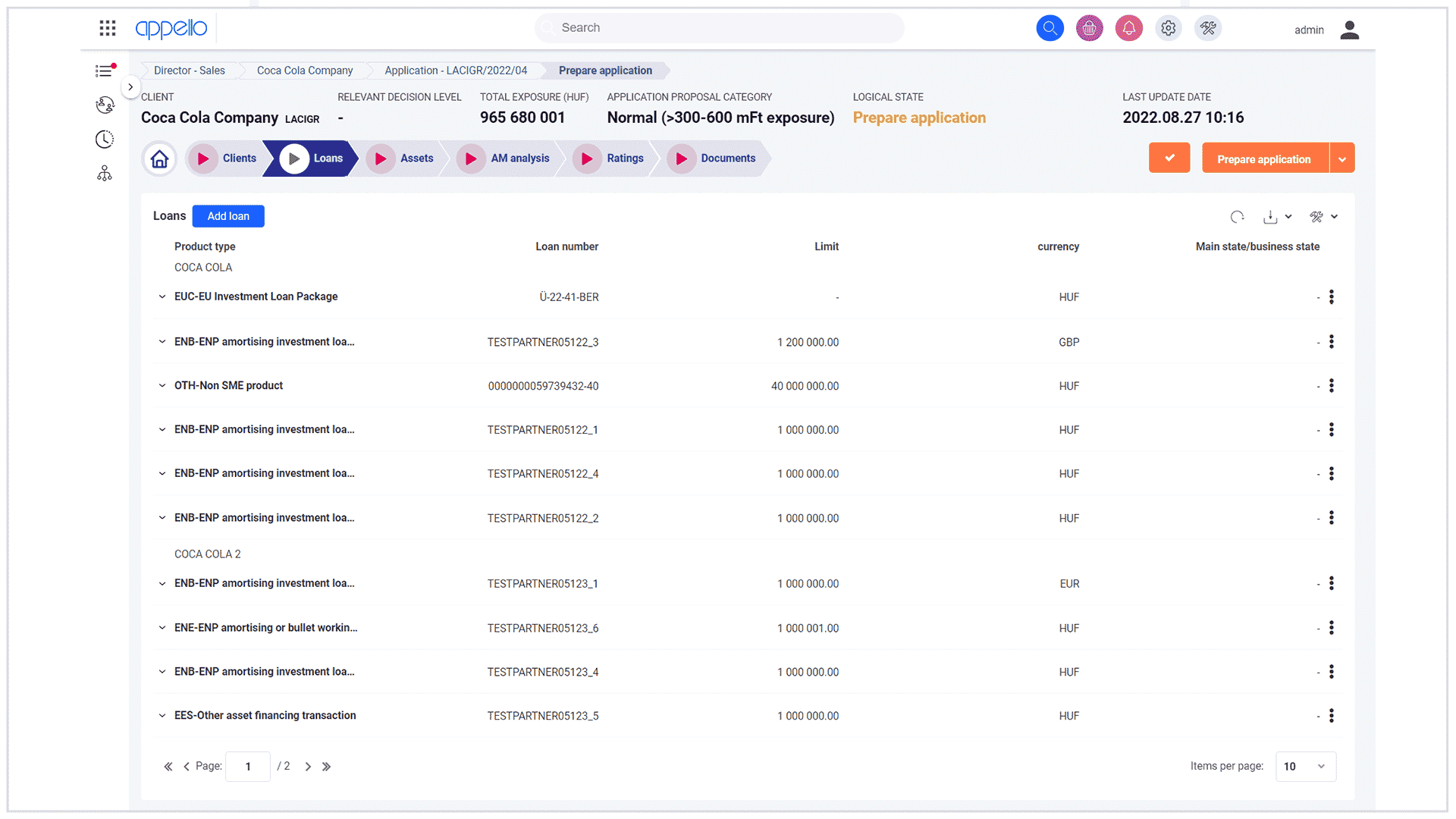

Loan monitoring

The Monitoring module adeptly fulfils the regulatory mandate for routine client assessments. Through automated processes, the system generates monitoring sheets encompassing client details and exposures, subsequently assigning them to designated users for assessment. Within these monitoring sheets, each client’s exposures receive individual ratings, and the approval process is diligently shepherded by a guided workflow.

Loan monitoring

The Monitoring module adeptly fulfils the regulatory mandate for routine client assessments. Through automated processes, the system generates monitoring sheets encompassing client details and exposures, subsequently assigning them to designated users for assessment. Within these monitoring sheets, each client’s exposures receive individual ratings, and the approval process is diligently shepherded by a guided workflow.

Loan monitoring

The Monitoring module adeptly fulfils the regulatory mandate for routine client assessments. Through automated processes, the system generates monitoring sheets encompassing client details and exposures, subsequently assigning them to designated users for assessment. Within these monitoring sheets, each client’s exposures receive individual ratings, and the approval process is diligently shepherded by a guided workflow.

Loan monitoring

The Monitoring module adeptly fulfils the regulatory mandate for routine client assessments. Through automated processes, the system generates monitoring sheets encompassing client details and exposures, subsequently assigning them to designated users for assessment. Within these monitoring sheets, each client’s exposures receive individual ratings, and the approval process is diligently shepherded by a guided workflow.

Are you interested?

Want to learn more about how our platform can modernize your bank?

Just schedule a call with one of our experts. We're here to help.

Are you interested?

Want to learn more about how our platform can modernize your bank?

Just schedule a call with one of our experts. We're here to help.

Are you interested?

Want to learn more about how our platform can modernize your bank?

Just schedule a call with one of our experts. We're here to help.

Are you interested?

Want to learn more about how our platform can modernize your bank?

Just schedule a call with one of our experts. We're here to help.