ApPello offers cutting edge, scalable digital lending solutions for banks of all sizes, reducing time to yes and time to money across segments and products – supported by AI technologies that facilitate seamless automation and intuitive collaboration between users and the system.

The Corporate & SME Loan Origination System streamlines lending, enables faster loan processing from application to disbursement, making complex customer, limit, loan and collateral structures transparent.

Streamline Loan Journey

Effectively manages lending for micro, SME, and large corporate segments.

Prioritizing Efficiency

The system is thoughtfully designed to streamline processes, reducing both TTY and TTM.

The system is a highly scalable, preconfigured solution for banks and financial institutions to automate unsecured retail lending.

Automated workflows

Create market leading, streamlined loan application and approval processes, with semi- or fully automated risk decision making!

Empower your team

Optimize and automize every step of the origination process with a comprehensive platform integrating intuitive internal and customer-facing UI and advanced analytics.

Attract profitable customers with best-in-class UX and TTM!

Optimized Decision-Making

Equips decision-makers with advanced tools like automated workflows and data-driven insights to streamline approvals and reduce processing time.

Real-Time Transparency

Provides real-time updates and notifications, ensuring customers are informed at every stage of the mortgage process.

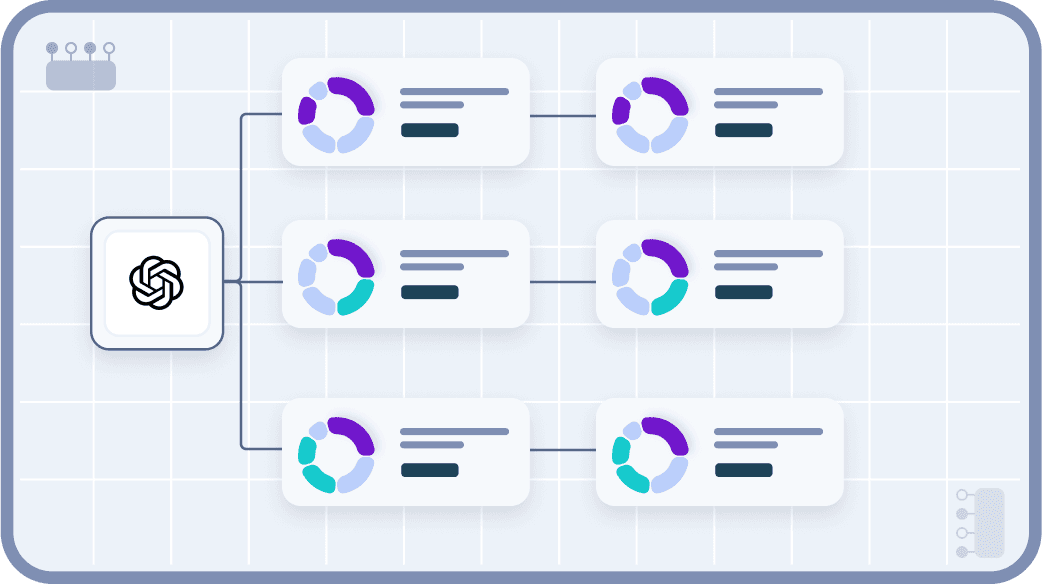

Transform your decision-making with a powerful Decision Engine that automates, optimizes, and personalizes business strategies for maximum impact.

Efficient Automation

Automates key steps like pre-screening and scoring, reducing errors and increasing operational efficiency.

Comprehensive Analytics

Risk decision automation with the Decision Engine