Unsecured Retail

Loan Origination System

Addressing the needs of retail loans, especially those requiring rapid decision-making and disbursement timelines, becomes effortless with the ApPello Loan Origination System.

This comprehensive solution incorporates a customer-centric front-end equipped with optional client onboarding capabilities. Additionally, the ApPello Retail Loan Origination Solution boasts robust monitoring features, facilitating the efficient tracking of processes and resource allocation.

Discover

Product Details

The ApPello Unsecured Retail Loan Origination System emerges as a potent instrument, enabling swift responses to fluctuations in the retail market landscape, thus enhancing key performance indicators such as time-to-decision and time-to-money. To counteract onboarding churn rates, clients are systematically led through each phase of the process, ensuring a comprehensive and guided experience.

The principal objective of the loan origination back-end and portal is to offer a seamless perception of the entire journey to new clients, and all verifications and other tasks are carried out at the background.

Users are navigated through each step of the process, aided by the integrated workflow engine (Camunda) and the Decision Engine, which allows flexible adaptation of credit policies and business rules to align precisely with current business requisites.

The Loan Origination System is a technologically crafted innovative tool, based on our modern, low-code microservices platform.

Benefits

Improved sales effectiveness with omnichannel capabilities and an enhanced customer experience

Cost reduction with optimised processes, a flexible toolset, changeable rules, screens, dataset workflow

Shorten origination processes through the use of automation, document management and integration

Enhanced customer experience with face recognition and

e-signature

Monitoring and reporting tools ensure process efficiency for lower operational and credit risk

Prompt reaction to market needs with easy configuration and easy to adjust credit policies & business rules

End-to-End

support of LOS

The ApPello Retail Loan Origination System comprehensively oversees the lending journey from the initial interaction all the way through disbursement, encompassing the entire lifecycle of the loan. This includes pivotal stages like cross-selling, prolongation, restructuring, and termination. Furthermore, it adeptly steers users from the origination phase and progressing through tasks such as registration, monitoring, maintenance.

In addition, this solution empowers users with the ability to tailor screens to their preferences while maintaining stringent data quality and coherence, featuring the capability to dispatch notifications or popup alerts.

Workflow of Unsecured Retail Loan Origination

Onboarding

- Credential and contact information management

- KYC processes

Acquisition

- Online loan application and self-service portal

- Personalised product offer

- Omni / optichannel

- Pre-screening

Origination

- Best product offer

- CRM – campaign management

- Risk-based pricing

- Cross-sell (multiple loan agreement)

- Income validation (screen scrapping – PSD2)

- Insurance and service selection

- Covenant management

Scoring

- PD, AML, Fraud, Credit Bureau, TAX database

- AI, Machine learning

- Credit limit calculation

- Test evaluation

Underwriting

- Risk assessment (policies, limits, triggers)

- Fully automated decision making

- 4 eyes principle

- Overrule, escalation processes

Contracting

- Automated contracting (FaceID, E-signature)

- Document checklist

- E-document, contract generation

Disbursement

- Pre-disbursement validation

- Multiple disbursement option

Monitoring

- Utilisation monitoring

- Pre- and soft collection support

Aftercare

- Up/Cross-sales opportunities

- Auto prolongation

- Restructuring and refinancing

- Credit suspension and termination

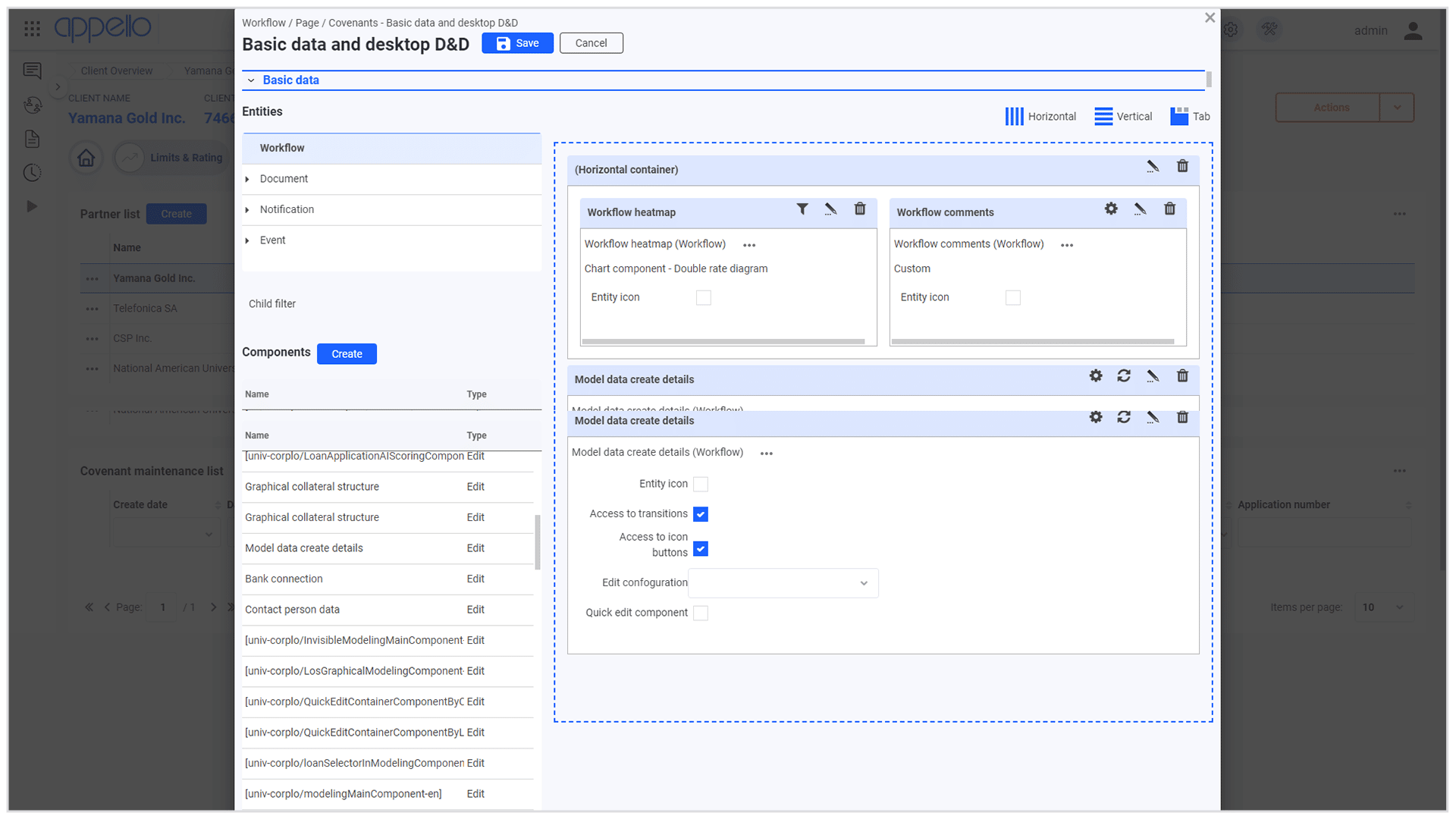

How to configure

In the Appello Digital Lending Platform, we’ve always used a drag-and-drop editor and the MVEL Rule Engine to configure screen layouts and behaviors. But now, you no longer need to learn the rule engine syntax. Configuration can be done through plain text, with the help of Chat GPT-4.

Faster and flexible access

to banking services

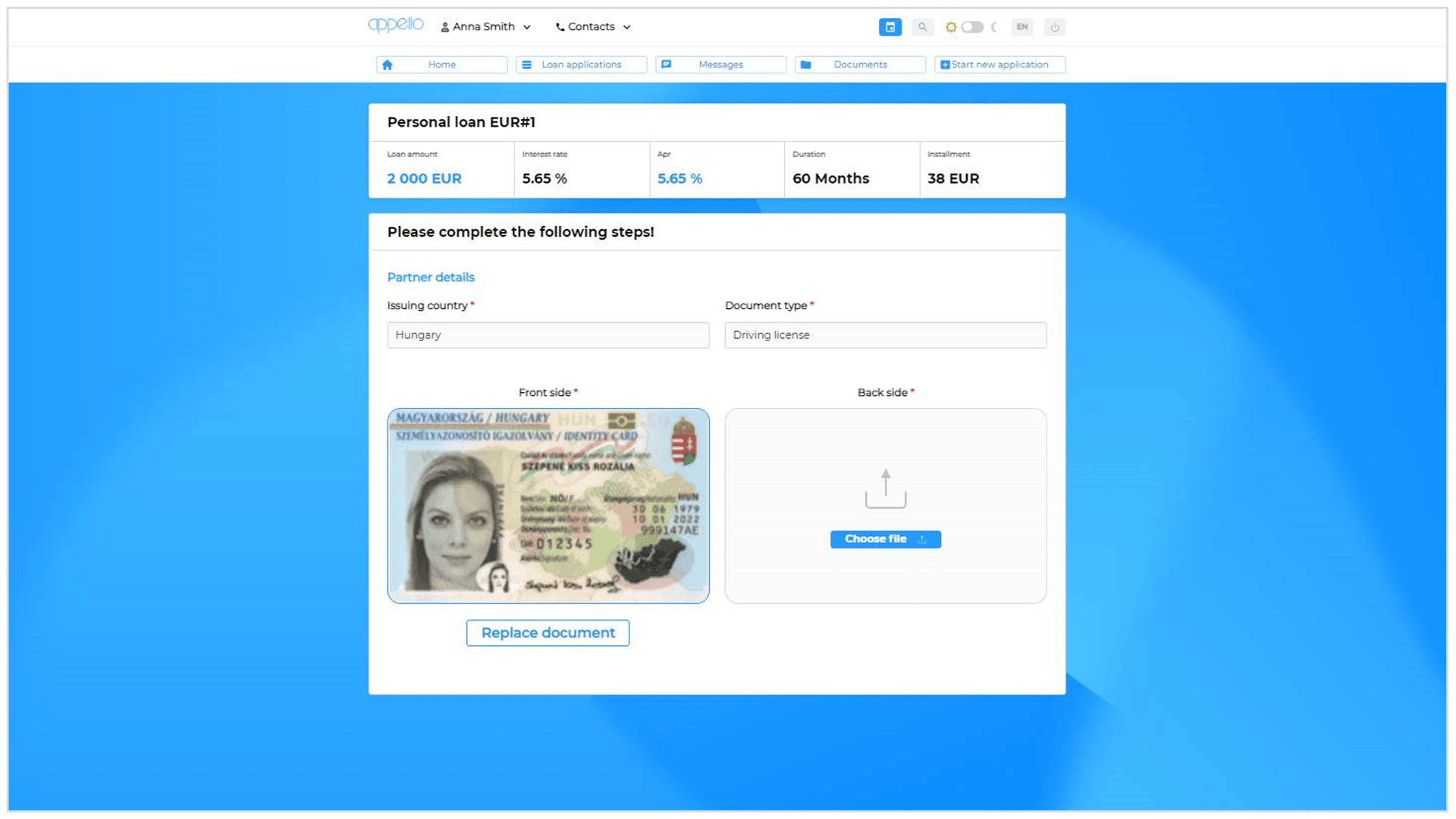

The onboarding platform streamlines the collection of essential customer information, empowering the bank to gain a deeper understanding of their preferences and requirements. This, in turn, facilitates proactive recommendations of the most pertinent products and services.

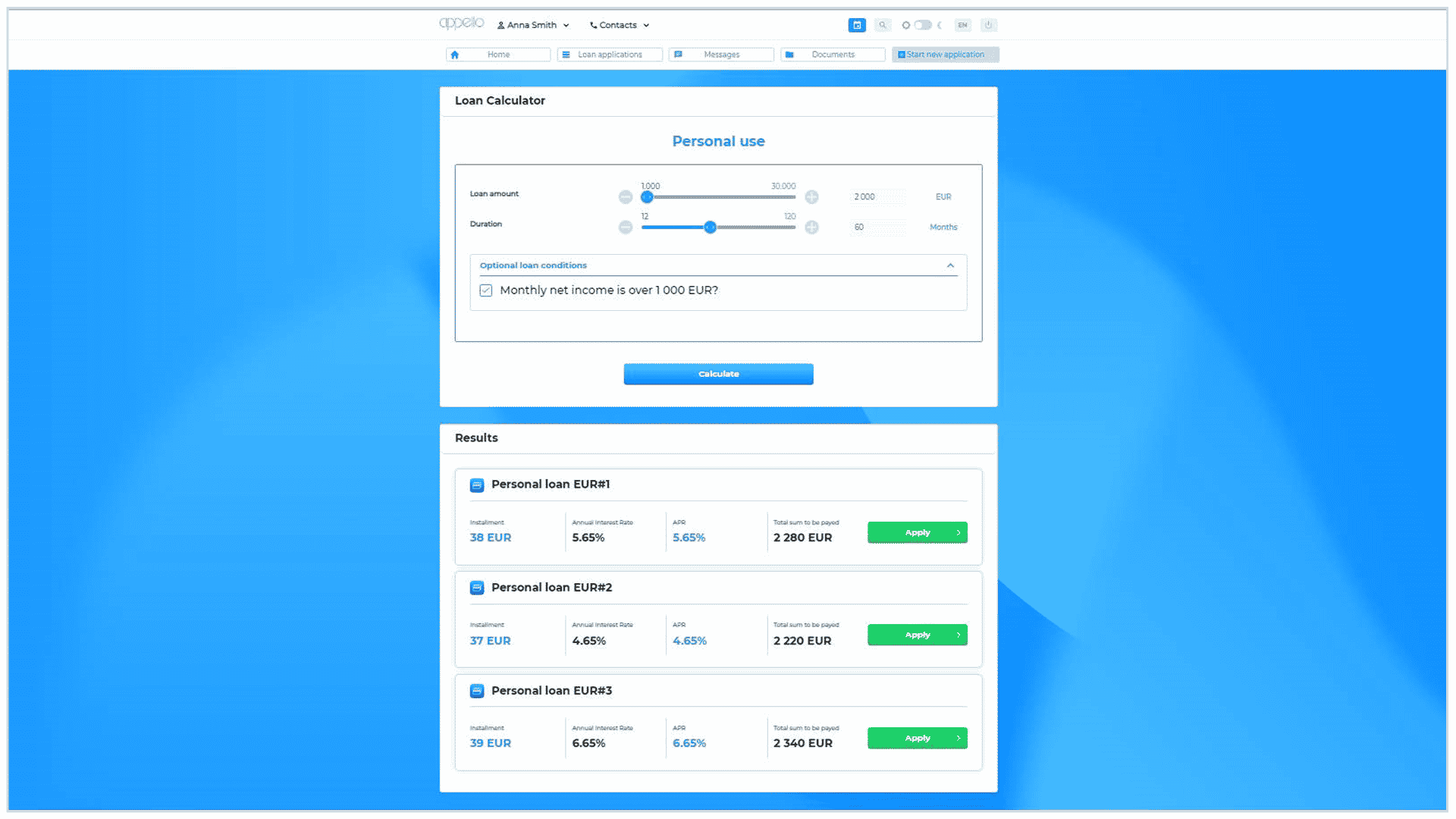

The ApPello Customer Portal within the Retail Loan Origination System elevates the customer experience through its contemporary and user-friendly functionalities. This platform attracts new customers while bolstering the loyalty of existing clients, all while driving down operational costs. For prospective clients, the Public Customer Portal offers the ability to compute rates and repayment conditions, providing preliminary estimates for monthly installments, total repayment amounts, as well as interest rates and APR.

Improved sales effectiveness

and customer satisfaction

The Retail Loan Origination System ensures rapid decision-making and swift disbursement while offering a high degree of adaptability in managing clients, loan products, workflows, and business rules. It presents a clear and succinct overview for the sales network, risk managers, and back-office personnel, leveraging distinctive visualization capabilities for user-friendly convenience. This extends to even encompass loan-collateral structures, aiding in the assessment of various application scenarios.

In today’s dynamic landscape, customers exhibit a hop-on hop-off mentality when engaging with financial services, constantly in pursuit of optimal solutions.

Decision

Engine

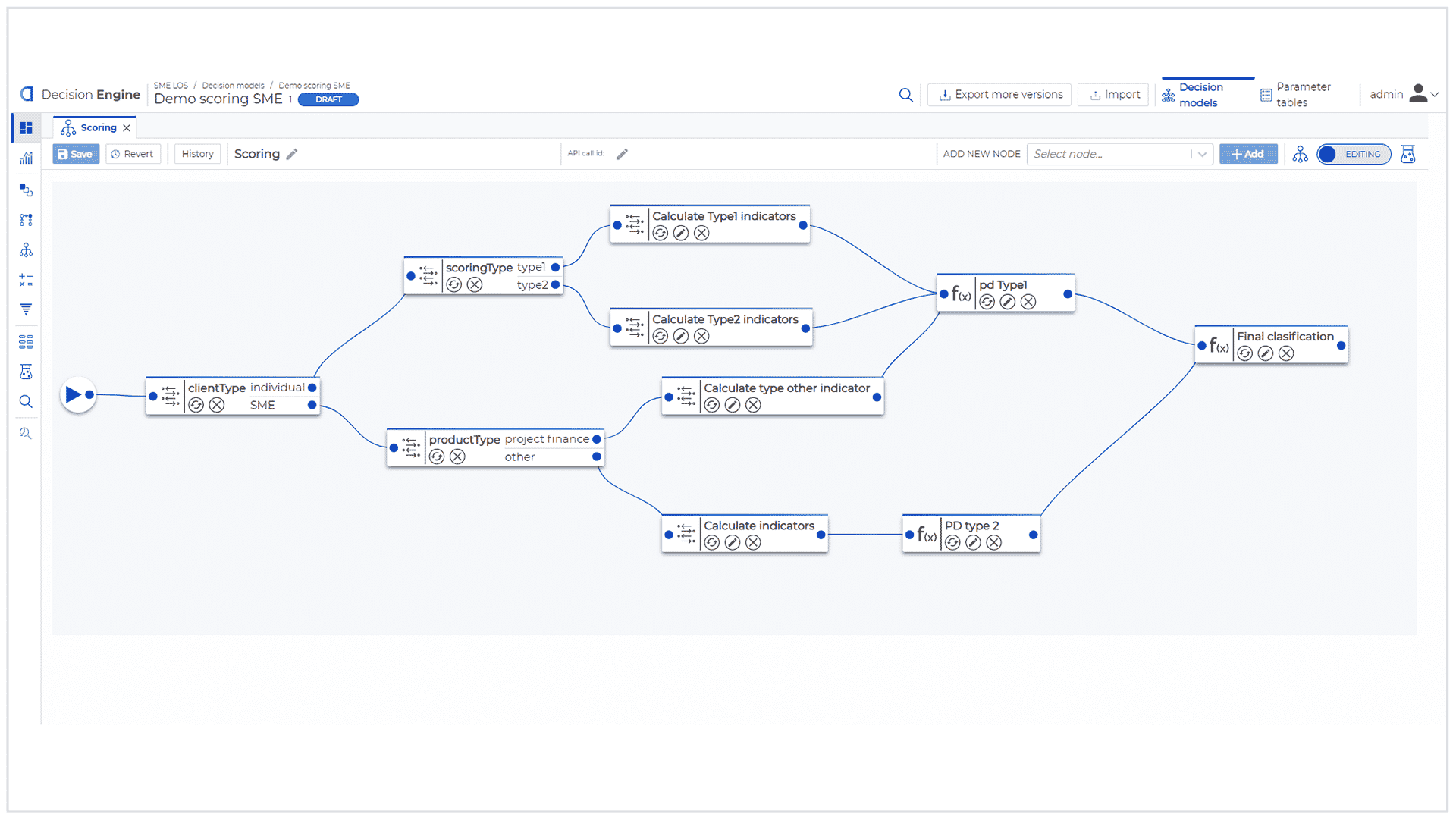

The integrated Decision Engine serves a multitude of functions including pre-screening, classical scoring, rating, limit computation, and the management of supplementary decision junctures. It boasts the capacity to accommodate an extensive array of distinct decision logics, each tailored to specific customer segments (including sub-segments), products, and product variants. The model variants can be further refined based on specific products or client sub-segments.

Business rules and decision logic, accompanied by user-friendly graphical representations, can be meticulously constructed and personalized by the bank’s staff members in relevant roles, even in the absence of intricate IT expertise.

Documents &

Contracts

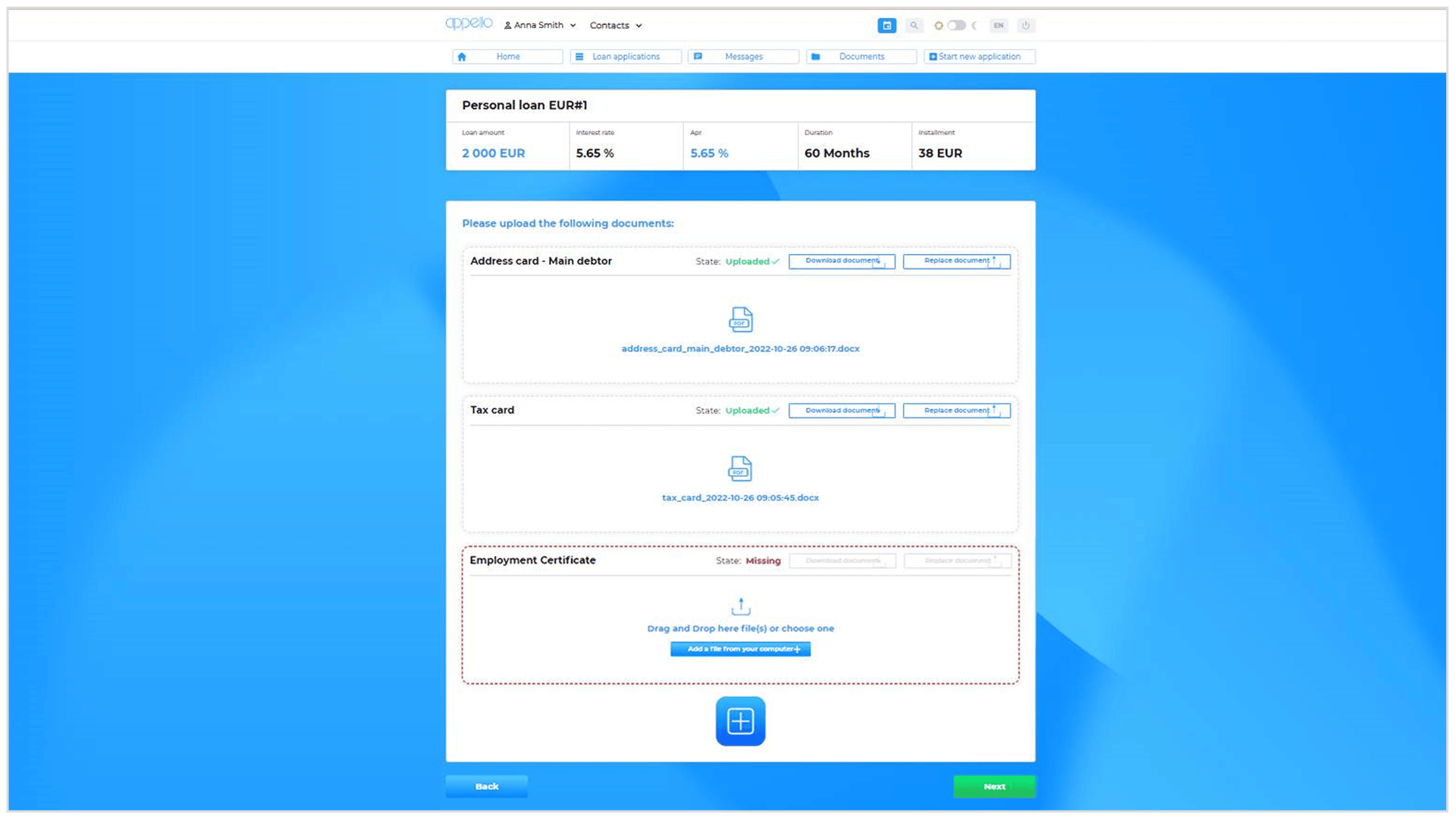

The ApPello Portal streamlines processes through automated document uploading, creating an entirely paperless and bureaucracy-free experience. Defining document requirements has never been more effortless.

Moreover, the portal seamlessly delivers prepared proposals, contracts, and more to clients. The inclusion of document management functionality simplifies tasks like document creation, storage, retrieval, and search. A seamlessly integrated digital signature function adds the finishing touch to this paperless workflow.

Within the LOS Solution, the Document Template Module and Document Store Module work in unison. The Document Template Module effortlessly handles various contract types, generating them automatically using MS Word templates.

Leveraging document management tools, a diverse range of documents can be swiftly generated based on templates, and subsequently populated with pertinent data available within the system. This proves invaluable, saving both time and effort within the loan origination process. Every aspect of the necessary paperwork, from loan proposals and contracts to notifications and statements, can be prepared efficiently. The digital signature feature adds an extra layer of assurance, verifying the integrity of contracts and agreements.

Configuration

over customization

The ApPello Loan Origination System empowers proficient users to exert comprehensive control over and tailor the entirety of lending-related workflows throughout their complete lifecycle. The integrated editor interfaces enable the definition of an unlimited variety of workflow types. Diverse workflows can be crafted employing distinct workflow steps, all without the need for ApPello’s involvement or IT team intervention. Parametrizing the prerequisites and conditions for the completion of these workflows is an effortlessly achievable task.

Flexibility extends to parallel tasks, which can be shaped based on real-time parameters. These tasks can share identical or distinct assignees and be executed in any sequence dictated by the specific parameters in place.

Our low-code platform accommodates a range of parameters, allowing banks to tailor workflows to meet various scenarios and business conditions.

Furthermore, the system offers an array of additional configuration opportunities:

- Screen design

- Dynamic fields

- Additional business rules

Collectively, these features provide a versatile and powerful toolkit for banks to finely tune and optimize their lending operations.

Business

Configuration

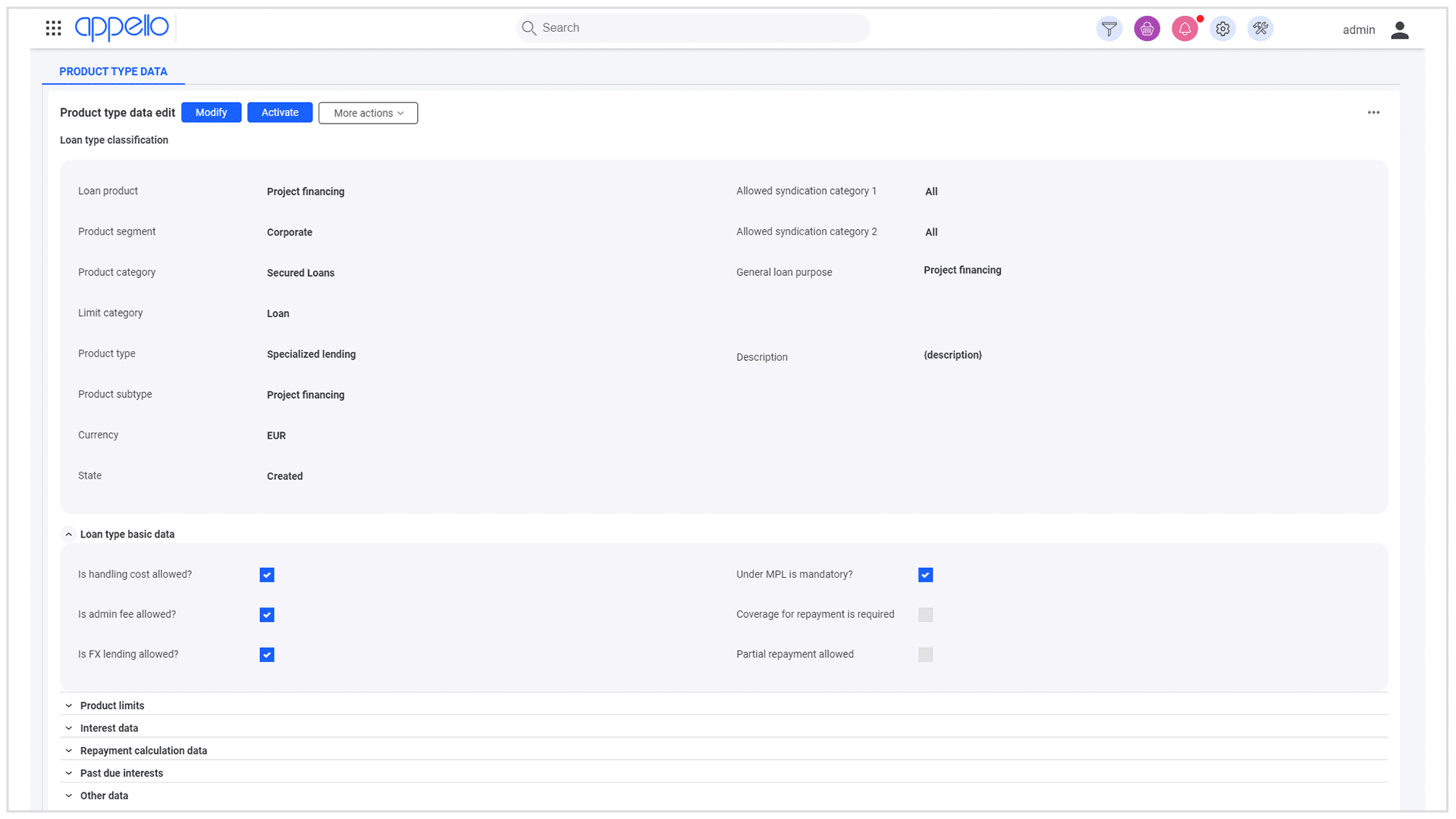

The ApPello Loan Origination System provides adept users with the authority to wield comprehensive command over and customize every aspect of lending-related workflows, spanning their entire lifecycle. The integrated editor interfaces empower the creation of an endless spectrum of workflow types. Varied workflows can be meticulously crafted utilizing unique workflow steps, all devoid of the necessity for ApPello’s involvement or IT team engagement. Tailoring the prerequisites and criteria for the fulfillment of these workflows is a task easily accomplished.

In addition, the system encompasses a spectrum of supplementary configuration prospects:

- Product catalogue

- Covenant catalogue

- Document type catalogue

Together, these attributes furnish banks with a versatile and potent toolkit, facilitating the precise calibration and enhancement of their lending operations.

Related

Products

You might also be interested in our other lending solutions

Mortgage

Loan Origination

ApPello Loan Origination System is an advanced end-to-end tool providing an efficient and profitable relationship between the bank and the borrower.

Decision

Engine

Speeds up and automates decisions. It is a segment and product-independent solution that can handle business-related decisions of varying complexity within a centralised platform.