ApPello’s

Digital Lending

Product range

Chose and benefit from ready-made but still highly customisable modules that work as a best-practice solution for several banks in Europe.

ApPello’s Digital Lending Systems provide financial institutions with solutions to assist them in responding to an

ever-changing banking IT environment.

ApPello’s digital Core Banking System (CBS) is a state-of-the-art, cloud-based solution that caters to a wide range of banking functionalities, including current accounts, savings, and lending.

ApPello’s Trade Finance System is a cutting-edge front-end and back-end solution designed to seamlessly support documentary transactions and all associated events, catering to both export and import processes.

ApPello’s Cash Optimisation Solution leverages AI-based support to forecast cash transactions, encompassing both deposits and withdrawals.

McKinsey states that organizations that use technology

to revamp the customer experience can carve out significant differentiation

increasing customer

satisfaction by

20%

reducing the cost

to serve by

40%

boosting conversion

rates and growth by

15%

How digital banking benefits you?

In a landscape shaped by digital transformation, financial institutions are driven to optimize their processes and elevate customer experiences. Appello’s Digital Lending Product range not only meets these demands but sets a new standard for loan management – from origination and servicing to collections. Through automated underwriting, document management, real-time loan monitoring, and an innovative collections tool, Appello’s solutions simplifies the loan lifecycle. This simplification reduces manual efforts, minimizes errors, and fosters stronger borrower-lender relationships.

By embracing innovation, Appello empowers financial institutions and borrowers alike to navigate the dynamic digital era with confidence and success.

Digitalization and digital transformation of core banking and lending processes using the latest technology is a core value of ApPello and is trusted by key European banks and financial institutes for more than 25(?) years

ApPello’s 25 years of experience is trusted by

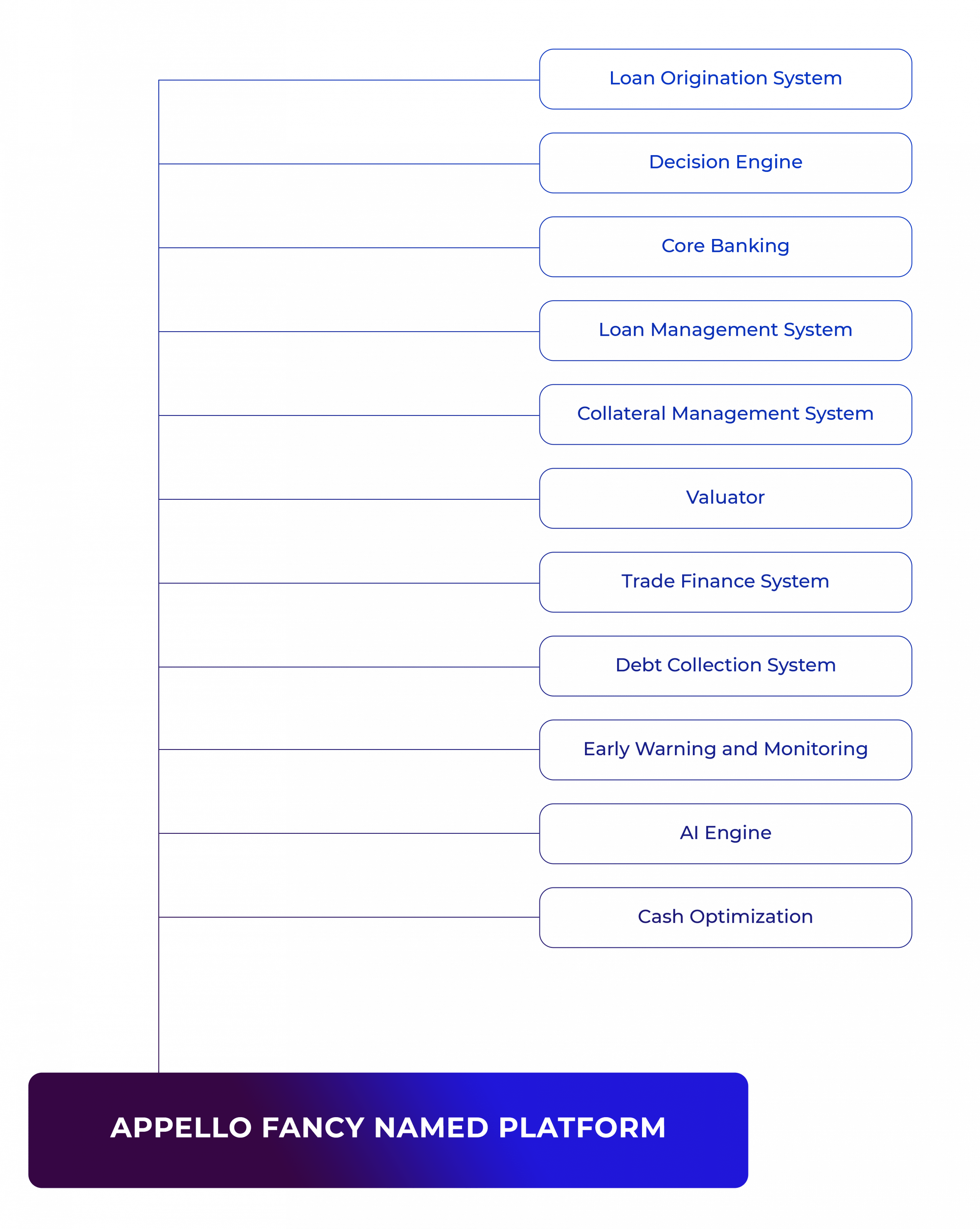

Build your own digital bank by ApPello’s solutions

Our advanced digital lending platform stands out as a game-changer in the industry, offering a comprehensive suite of tools designed to simplify the entire loan lifecycle – from origination to servicing.

Our principle is to develop customer centric solutions that not only meet the business requirements, but can also be easily configured by business users independently of an IT team.

How ApPello’s solutions impact your business metrics?

Increasing

customer engagement

End-to-end loan origination process results 30-40% shorter time-to-yes and time-to-money and thus customer satisfaction

Improved

sales efficiency

Quick response to market needs, business configuration of rules and processes within days, Up to 70% of rules are business configurable

Reduced

project costs

End-to-end loan origination process results 30-40% shorter time-to-yes and time-to-money and thus customer satisfaction

Reduced

cost to serve

Up to 20% enhanced team performance through monitoring, reports & dashboards

LENDING

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

CORE BANKING

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.